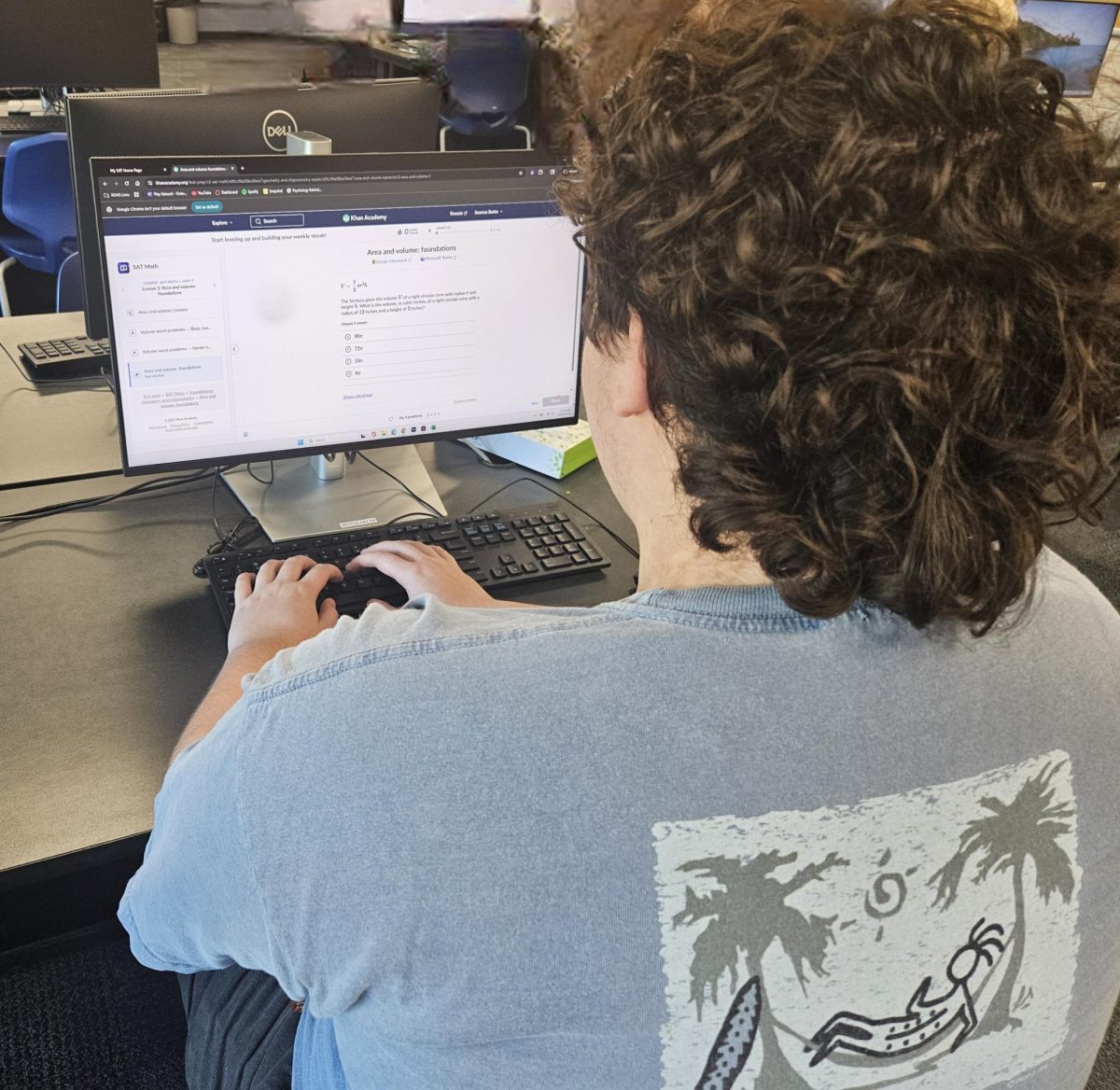

With the cost of college on the rise, students who planning on post-secondary education are considering their financial aid options. With millions of applications and billions of dollars awarded per year, the FAFSA (Free Application Financial Student Aid) is a form of federal financial aid that many students rely on to help fund their college education.

While known for being a lengthy form determining eligibility for financial aid that one can use to help with the burden of college costs, FAFSA will be getting a new look for 2024-2025

With Congress still processing the many changes, a significant change students have already noticed is the later release date. The FAFSA form was previously released on October 1st, leaving students room to do the application before early admissions close. This year, the FAFSA is projected to be released sometime in December. Though the later release may sound worrisome, the form will be reduced from 108 questions to 36, making it quicker to fill out.

The later release will delay students’ submission of their FAFSA to colleges, which a majority do require. The later release of FAFSA will also delay students from being certain about their eligibility for a Pell Grant, which is a form of federal financial aid that targets aid for students who are struggling financially.

Pell Grant eligibility will be decreasing for incomes between 60K and 100K, which includes the majority of the middle class. However, those who are eligible are looking to qualify for more than those who have in previous years from their Pell Grants. According to the State Higher Education Executive Officers Association (SHEEO), the change from EFC (Expected Family Contribution) to SAI (Student Aid Index) will have a more positive effect on students’ eligibility for aid.

One change that is going to harm a lot of families is the removal of the ‘sibling discount.’ In years prior, households with multiple children in college could qualify for more financial aid, but now each student is considered individually. FAFSA would assume that the savings would be split between each child, but now they are expecting each child to receive that same amount.

Even though there are hundreds of changes to the FAFSA, SHEEO claims that the form will be easier for families to fill out. ROHS counselor Kevin Botos says that the change shouldn’t have a significant effect on the future of FAFSA.

“Short term, it’s a different time frame, but in the end, the adjustments that FAFSA is making timeline-wise and in marketing should benefit students and Royal Oak families by securing a FAFSA package that best represents the needs of the student for post-secondary educational opportunities,” he said.

Royal Oak High School staff is available to help and assist students throughout their transition to post-secondary education. Botos emphasized that the counseling team is on board to help with the process.

“While this can feel overwhelming at times, please be assured the counseling staff will send out information to inform all seniors of the changes as we receive them,” he said.

It’s recommended that families who plan on applying for the FAFSA go ahead and register for an FSA ID through the FAFSA website in order to be prepared. Families can also collect any important financial information that they may need to make the application process quicker. During the time before the FAFSA release, most families can prepare and make themselves feel more ready for the process.